While Bitcoin fell below $19k and was on the verge of falling to the local bottom, Ethereum confidently maintained its bullish positions. After a local recovery impulse of the first cryptocurrency, the main altcoin resumed its upward movement. The asset has reached the upper boundary of the resistance zone and, as of this writing, is trying to gain a foothold above the $1,700 level. In general, the altcoin successfully implements the bullish market momentum ahead of the Merge update. However, should we expect a full-fledged upward movement of the cryptocurrency shortly before the merger?

From the fundamental point of view, the answer to this question seems not so obvious. Two days ago, the Bellatrix update took place on the Ethereum network, which became the final chord of preparing the altcoin for the transition to PoS. The upgrade was successful, but investors had some doubts. They were dictated by a significant increase in the number of missed blocks in the ETH network after the Bellatrix update. The indicator increased by 1,700%, and the number of blocks that did not pass the check on the first attempt reached 9%, against the norm of 0.5%. The Ethereum developers said that the problem was related to nodes that did not install new software. It is reported that about 25% of the nodes are using the old collateral, but even a small percentage caused failures in the ETH network.

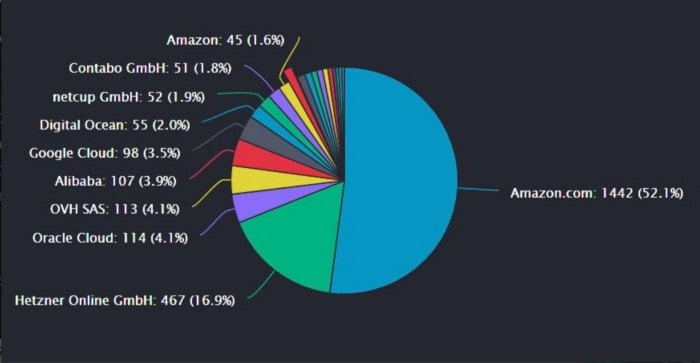

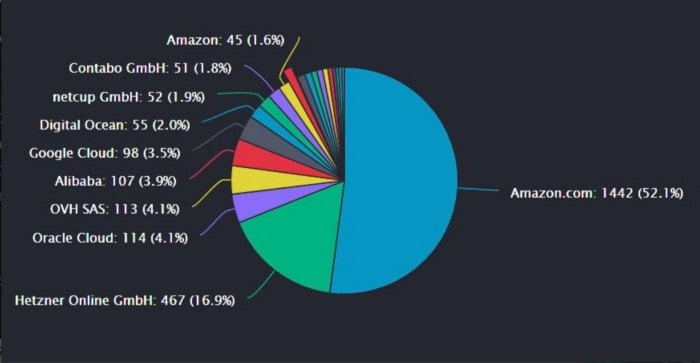

Questions about the decentralization of Ethereum are also gaining momentum, because more than 50% of all ETH nodes are made up of the United States and Germany. Amazon is the end user of more than 50% of Ethereum nodes, and the Geth open source project remains the main enabler for most of the nodes. However, judging by the growing volumes of trading and the increase in addresses, the market is not very worried about the possibility of transactional censorship. The situation with the update of Ethereum remains stable and interest in the main altcoin is growing. Given the fundamental interest of investors in Ethereum, a similar situation should be observed in technical metrics.

On the daily chart, Ethereum remains bullish. The price managed to hold the key support level at $1,400. Thanks to this, the "cup and handle" pattern remains relevant and, consequently, the bullish potential of the price movement to $2,700-$2,800. Technical indicators also confirm the bullish market sentiment. The Relative Strength Index crossed the 50 level and continues to move up, which indicates growing buying volumes. The stochastic oscillator is also successfully implementing bullish impulses and is approaching the overbought zone. Given the proximity and fundamental nature of the Merge update, the metric will remain close to this zone until the merge is completed.

An important and positive signal for the ether was the fall in the level of Bitcoin dominance to 36%. Subsequently, the metric recovered to 39%. However, this is direct evidence that Ethereum is temporarily at a higher investment preference than Bitcoin. In other words, the main flows of investments, including institutional ones, are directed to the main altcoin. This thesis is also confirmed by colleagues from Chainalysis, who are sure that ETH has taken on the burden of temporary leadership. Experts report that due to the improvement in the technical characteristics of ETH, including staking, altcoin will become even more popular among large players.

This thesis is confirmed by the on-chain metric showing the number of addresses with 1000+ ETH. A significant increase in the number of addresses with this amount of ether coins indicates a high level of confidence in the upcoming update. However, it may also indicate investors' plans to take advantage of the staking feature after the merger. For ETH, this is doubly positive news, as profitable staking will allow the asset to avoid a sharp and massive sell-off. However, we should expect a slight drop in the price of Ether after the update due to market conditions.

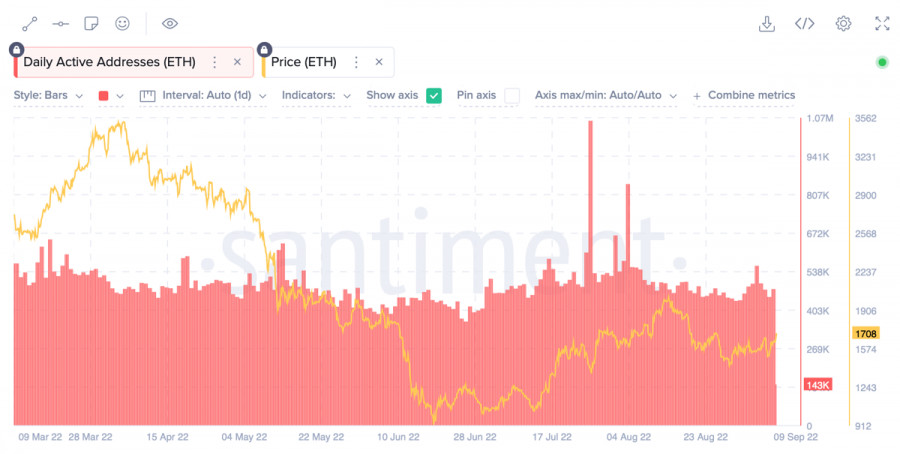

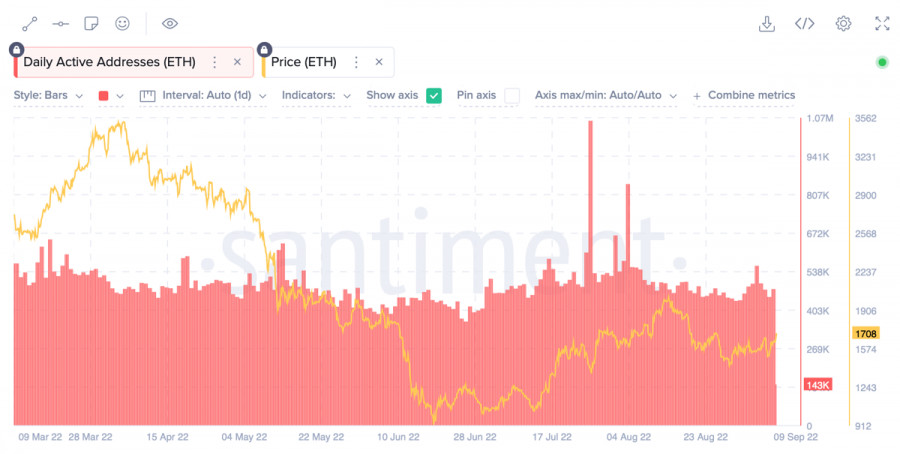

Ethereum on-chain metrics also show positive dynamics. Trading volumes have taken a sharp upward direction, but still do not reach the levels of mid-July, when the altcoin was at its peak of growth. The number of unique addresses in the cryptocurrency network remains high, but practically unchanged. The indicators of the main on-chain metrics indicate the initial stage of the emergence of an upward trend. It is likely that the numbers will continue to rise ahead of the merger and will peak on September 15–16. It is then that we should expect a peak in the growth of ETH/USD quotes.

Given the fundamental reasons for growth and investors' faith in a successful upgrade, there is no doubt about the local bullish trend of ether. On the eve of the merger, the asset will consolidate and gradually approach $1,800–$2,000. Given the successful movement in this area a few weeks ago, one can be sure of ETH/USD consolidation above $2,000.

The main targets of Ethereum within the bullish movement due to the Merge update are the $2,000-$2,100 and $2,400-$2,500 areas. Most likely, the price is able to go higher and stab higher levels, but the main potential ends in the $2,400-$2,500 area. Ethereum update will have a positive effect on the cryptocurrency and DeFi/NFT market, but given the macroeconomic background, fundamental shifts should not be expected.