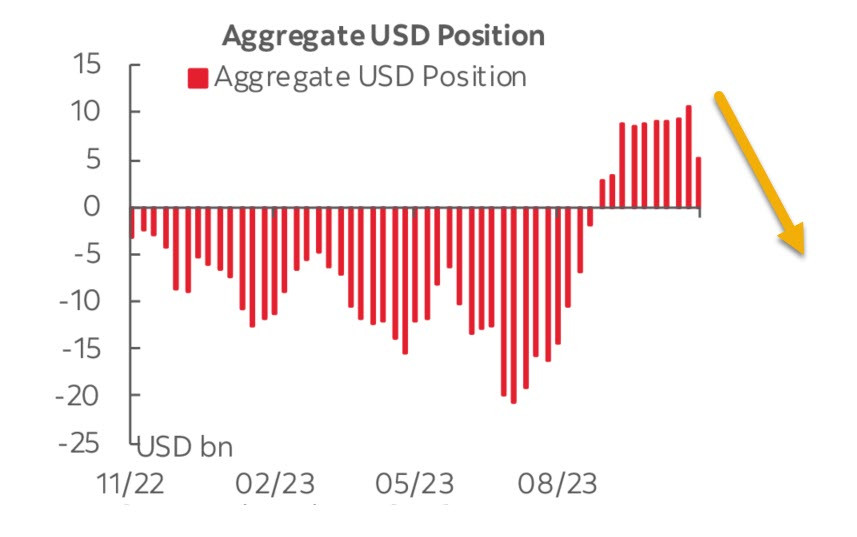

The CFTC report published on Monday showed a sharp decline in the net long USD position. The weekly change was -5.422 billion, and the bullish bias dropped to 5.126 billion.

Global yields are changing within narrow ranges, with no distinct dynamics. Lower expectations for the Federal Reserve interest rate have led to an additional influx of currency into stock markets, sustaining risk appetite, which mounts pressure on the dollar. However, this trend is unlikely to develop further since global economic growth forecasts remain negative.

On Wednesday, revised data on US GDP for the third quarter will be released, along with October data on personal consumption expenditures, which will show the resilience of consumer demand. The report may fuel activity in the markets.

The US dollar is expectedly under pressure, but to a large extent, the corrective factor for Fed interest rate forecasts has already been played out, and we await new benchmarks.

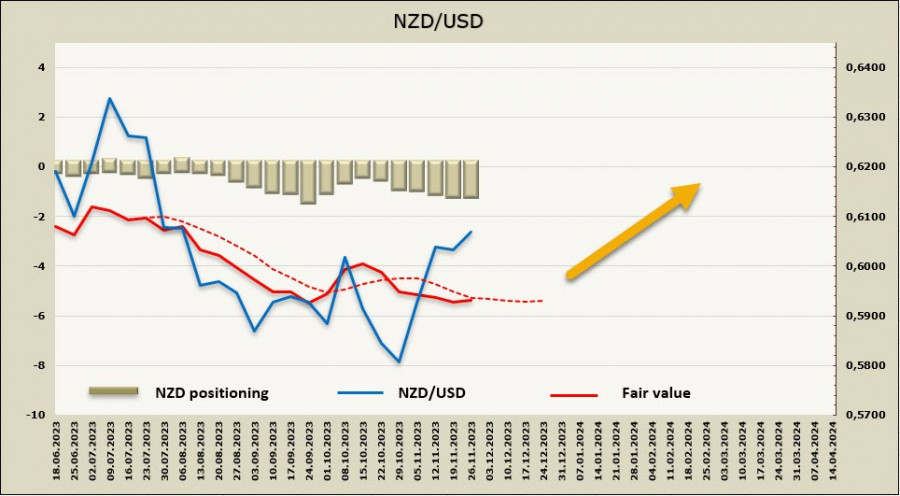

NZD/USD

The Reserve Bank of New Zealand (RBNZ) held its meeting on monetary policy. It was expected that the rate will be kept at 5.5%, despite new data emerging after the October meeting, indicating the state of the New Zealand economy.

In particular, GDP for the second quarter turned out to be significantly higher than expected, which is a positive sign for the stability of the national currency. Tradable inflation in the third quarter was below expectations, a volatile part of overall inflation, but still a positive factor.

Data for October showed a slowdown in price growth, allowing forecasts for the third quarter to be adjusted from 0.9% to 0.6%. Overall, the situation does not force the RBNZ to take any immediate action. Forecasts regarding the Federal Reserve's policy have stabilized, bond yields in both the US and New Zealand have been trading sideways for the past week. If the RBNZ meeting ends without surprises, for which there are no prerequisites, there is no expectation of a strong movement in NZD/USD.

Regarding long-term trends, it is worth taking note of the expected decline in personal income taxes starting from July 1, 2024. It is expected to lead to an increase in real incomes, particularly a 1.7% increase in average wages, boosting consumption and GDP, ultimately supporting inflation. Accordingly, the RBNZ must do most of the work to contain inflation before July, providing some reason to expect more austerity and will hence, support the kiwi.

The speculative interest in NZD has hardly changed, with a net short position of -1.019 billion, and the price has shown no distinct dynamics.

In the past month, NZD has been strengthening against the U.S. dollar, but has yet to breach the bearish channel. We expect traders to try and reach the resistance at 0.6210/30 (upper band of the channel), but the chances of a breakthrough and an upward reversal remain low. The nearest support is at 0.6050, followed by the middle of the channel at 0.5060/70. It is unlikely for the pair to breach these boundaries in the short term.

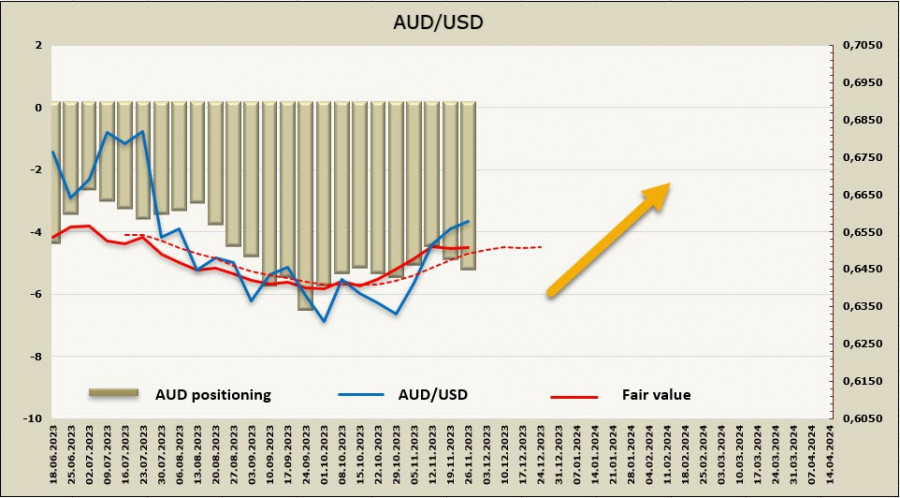

AUD/USD

In Australia, inflation is presumed to have peaked and is beginning to decline, although the pace of the slowdown towards the target range is not remarkable. The forecast for the Reserve Bank of Australia's future course of actions suggests another rate hike from the current 4.35% to 4.60% in February, with this rate expected to be maintained until the end of 2024, after which a rate cut will begin.

Based on these forecasts, one can understand how the yield spreads will change. The forecast for the Fed's rate suggests no further hikes, and a rate cut is expected to begin in June 2024. Accordingly, until June, the spread will favor the dollar, then it will start to narrow, and by November, yields will level off. This scenario does not imply significant movements in either direction, and the actual dynamics of AUD/USD will largely reflect economic prospects and real yields, adjusting for inflation.

Since inflation in the U.S. is slowing down faster than in Australia, and America is expected to reach the target sooner, the aussie essentially has no strong grounds to strengthen against the greenback, except for the possible rise in commodity prices. Considering that global economic forecasts suggest a slowdown, we do not expect a strong increase in commodity demand that could give the aussie an additional advantage.

Based on these considerations, it is logical to assume that the current rise in AUD/USD is generally of a corrective, rather than fundamental nature. After following the momentum, driven by the reassessment of the Fed's rate plans, the AUD/USD pair is expected to resume its decline or, at the very least, enter a sideways range.

As indicated in the CFTC report, the Australian dollar turned out to be the only G10 currency for which overall positioning worsened – the net short AUD position increased by 495 million over the reporting week to -5.112 billion. The price is still above the long-term average, but the dynamics have turned negative.

AUD/USD continues to rise, and it may continue to increase further, but the upward movement could end at any moment. The 0.6690/6710 area, marked as the target in the previous review, has not been reached, and it is still relevant, but the likelihood of a stronger rise is in doubt. Expect attempts to reach 0.6690/6710; however, a breakthrough is unlikely. A more probable scenario is consolidation followed by a pullback. The nearest support is at 0.6525, followed by 0.6450/60. Trading is likely to continue within the specified boundaries.