This week, on Tuesday, U.S. markets continued the upward trend, entering the final week of the year with anticipation that the Federal Reserve might start cutting interest rates as early as March.

All three key U.S. stock indexes rose after the Christmas holidays, with the S&P 500 index updating its record intraday level first reached in January 2022. All are on track for significant monthly, quarterly, and annual growth.

Shares of large-cap companies sensitive to interest rate changes and the semiconductor sector led this trend.

Last Friday, these indexes showed their eighth consecutive week of gains – the longest winning streak in many years, made possible by economic data indicating a slowdown in inflation and approaching the Federal Reserve's annual target of 2%.

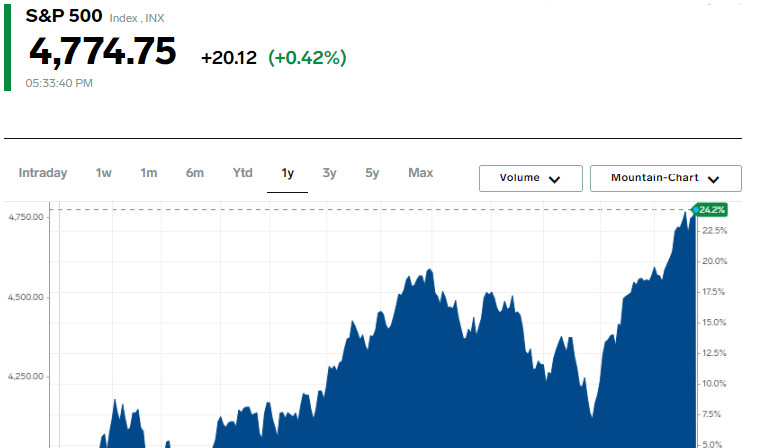

The S&P 500 index is on the verge of its most significant quarterly rise in the last three years and is just half a percent from its historical high, recorded in January 2022.

If the index exceeds the level of 4796.56, it will confirm that it has entered a bull market phase since reaching the lowest point of the bear market in October 2022.

The eight-week stock rally accelerated two weeks ago, after the Federal Reserve signaled the end of the rate-hiking cycle, opening the door for potential rate cuts in 2024.

According to the latest updates from CME Group's FedWatch tool, investors assess the probability of the Federal Reserve cutting the target rate by 25 basis points in March as extremely high – at 72.7%.

The Dow Jones Industrial Index (.DJI) showed impressive growth by 159.36 points, or 0.43%, reaching 37,545.33. The S&P 500 (.SPX) also showed positive dynamics, adding 20.12 points, or 0.42%, reaching 4,774.75, while the Nasdaq Composite Index (.IXIC) strengthened its positions by 81.60 points, or 0.54%, closing at 15,074.57.

Positive closing was noted in all 11 key sectors of the S&P 500 index.

The most significant percentage growth was recorded in the energy sector (.SPNY), fueled by rising oil prices due to increased concerns about supplies from the Middle East. This trend is further strengthened by optimism related to expectations of Fed rate cuts, which in turn supports hopes for increased demand.

Shares of Manchester United jumped 3.4% following the news of billionaire Jim Ratcliffe's deal to purchase 25% of the club's shares at $33 per share.

Shares of Gracell Biotechnologies (GRCL.O) rose 60.3% following the announcement that AstraZeneca (AZN.L) intends to acquire the Chinese company for $1.2 billion.

Intel Corp (INTC.O) shares also showed a significant increase of 5.2% following the news that the Israeli government had granted $3.2 billion for the construction of a $25 billion plant planned to be built in southern Israel.

On the New York Stock Exchange, the number of rising issues exceeded the number of falling ones by a ratio of 3.31 to 1, while on Nasdaq, this ratio was 2.25 to 1 in favor of rising companies.

The S&P 500 index demonstrated remarkable dynamics, reaching 50 new 52-week highs without a single new low, while the Nasdaq Composite index recorded 222 new highs and 48 new lows.

The trading volume on American stock exchanges amounted to 9.99 billion shares, less than the average of 12.56 billion over the last 20 trading days.

The yield on 10-year U.S. Treasury notes decreased, dropping to 3.895%, while the yield on two-year Treasury notes rose by 1.8 basis points to 4.3584%.

U.S. oil prices slightly reduced their previous growth, finishing the trades with a 2.1% increase to $75.12 per barrel. Meanwhile, Brent oil prices rose by 2.01%, reaching $80.66 per barrel.

The U.S. dollar index fell by 0.17% to 101.47, almost matching the five-month low of 101.42 recorded last Friday. A weaker dollar helped the euro strengthen by 0.3% to $1.104.

Investors continued to analyze data published last Friday, which showed that U.S. prices fell in November for the first time in more than three and a half years, highlighting the resilience of the U.S. economy.

U.S. inflation, measured by the Personal Consumption Expenditures (PCE) Price Index, decreased by 0.1% last month.

Stock investors welcomed recent signals from the Fed about the prospects for rates. Following its policy meeting on December 13, the Fed indicated that it had reached the end of the rate-tightening cycle and opened the door for rate cuts next year.

Currently, markets assess the probability of the Fed cutting rates by 25 basis points in March at 75%, according to data from the CME FedWatch tool, compared to a probability of just 21% at the end of November. Markets also anticipate rate cuts of more than 150 basis points next year.