The macroeconomic data coming in the last days of the outgoing year are secondary and do not affect the assessment of currency exchange rate prospects.

Some regional branches of the Federal Reserve have reported on manufacturing activity in December. The Chicago Fed reported some increase in activity, Dallas believes that manufacturing activity has not changed after a contraction in November, and Richmond sees a decline. It is a mixed bag of data, but one thing is clear - the impetus for GDP growth has clearly slowed down, the US is losing one of the key advantages that provided an influx of funds into the stock market and demand for the dollar.

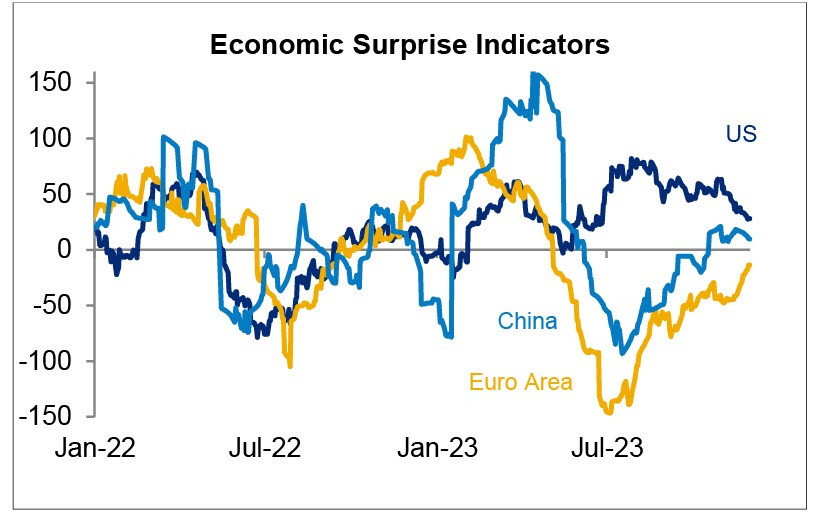

Overall, in the last month, US data have turned out worse than expected, as indicated by the clear slowdown in the Economic Surprise indicator. At the same time, news from Europe have been better than expected, which is partially responsible for the euro's stability, as well as better-than-expected news from China. The latter factor, along with expectations of a Fed rate cut, is clearly supporting demand for commodity currencies.

We did not expect any surprises during Thursday's European session, as no important news reports are scheduled for the day. In the evening, the market may be stirred by the weekly US labor market reports. In any case, it is necessary to consider that risks increase in thin markets even in the absence of significant macroeconomic factors.

The US dollar remains under pressure, and it still doesn't have any reason to rise.

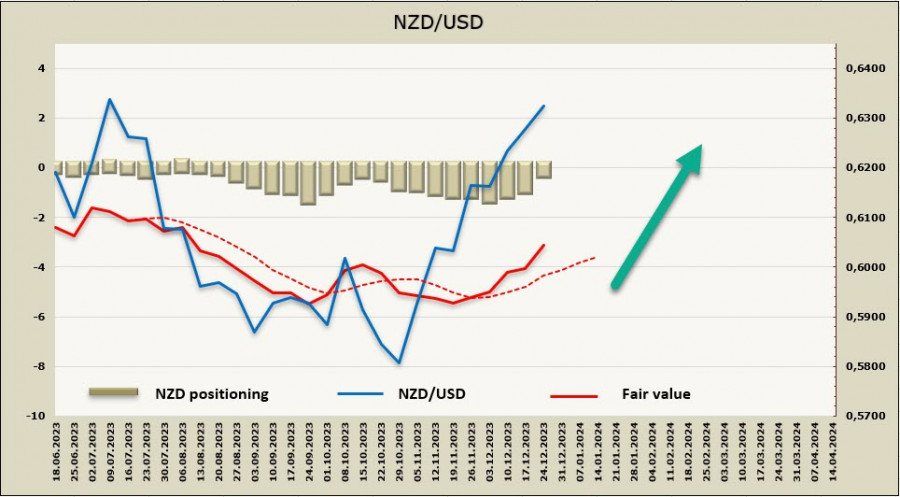

NZD/USD

The flow of economic news from New Zealand in December has not improved, with the economy showing a decline in three out of the last five months, increasing the likelihood of a GDP contraction in the last quarter.

The Reserve Bank of New Zealand rate has been at 5.5% since May. However, unlike the Fed, at its last meeting on November 29, the RBNZ took a much more hawkish stance, changing a series of forecasts that increased the probability of further monetary tightening. The market sees the rate peaking at 5.7% with approximately a 6-month delay before the start of an easing cycle, with no expected full rate cuts until mid-2025.

Despite the market's initial skepticism towards the RBNZ's hawkish stance and New Zealand bond yields starting to decline in sync with the market, it is still necessary to consider that the difference in monetary policy approaches between the RBNZ and the Fed will continue to grow. Risk appetite is also increasing rapidly, providing a basis for the rise of commodity currencies, particularly AUD and NZD.

No economic news scheduled on Friday, so the kiwi will primarily move based on the general market direction, which satisfies risk appetite. Therefore, there is no reason to expect a downturn in NZD/USD unless some unexpected information emerges in the coming days that would cause a reassessment of risk appetite prospects. The chances of such an event are still small.

The net short NZD position has decreased to 0.4 billion, and the price is firmly moving higher, indicating a shift in financial flows in favor of the kiwi.

NZD/USD continues to advance, marking a 5-month high, and there are no signs of it losing momentum. The nearest target is 0.6409, and then 0.6533. A corrective pullback to the downside is unlikely in the current conditions.

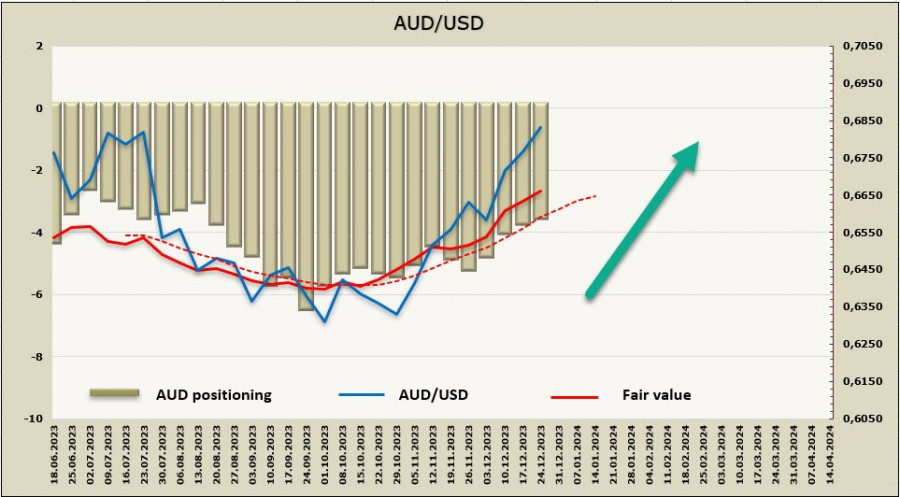

AUD/USD

The primary factor affecting the aussie's exchange rate is directly related to the inflation level and the response to incoming Reserve Bank of Australia data. Currently, there is a growing belief that inflation is slowing down, with a confident forecast for a decrease in inflation in the fourth quarter as government subsidy programs expire and wage growth remains moderate, allowing for a reduction in inflation expectations.

The growth of production has also slowed down, and consumption is expected to decline.

The RBA interest rate forecast at the moment is as follows: it is expected that in February, the rate will be raised by a quarter percent from the current 4.35% and will remain at 4.6% until the end of 2024. This forecast supports demand for the AUD, as the Fed's interest rate forecast implies 4 rate cuts in 2024, meaning that the yield spread will shift in favor of the Australian currency.

The risk lies in how quickly the economy will slow down. If GDP growth slows down faster than forecasts, and the purchasing power of the population declines at a rate worse than expected, then the RBA may change its view on the interest rate level earlier than the current forecasts and may also start lowering rates. Such a scenario is possible, but it still assumes changes not in the near future but rather in the second half of 2024, which is not relevant for the current demand for the aussie.

We assume that the markets will continue to react to the changes in the approaches of the Fed and the RBA, while the demand for the aussie will remain stable.

The net short AUD position decreased to -3.1 billion during the reporting week, positioning is slowly shifting in favor of the aussie. The price is above the long-term average and is steadily rising.

AUD/USD is building on its success, approaching the resistance area of 0.6890/6905, which is the nearest target. Beyond that, the target shifts to 0.7160. However, considering that the aussie's rise in the past two months has been dealt with nearly no corrections, there's a possibility of a technical retracement within the 38% range of the move, after which the uptrend will likely continue. If the pair reaches the level of 0.6890/6905, support will shift to the area of 0.6660/90, where, in the event of a retracement to this level, traders will likely go back to buying the pair again.