It is risky to trade dollar pairs today. At the end of the US trading session, the Fed will announce its "verdict," which will determine the future fate of the US currency – at least in the medium term. Most experts are confident that Federal Reserve Chair Jerome Powell will finally announce the start of tapering a large-scale quantitative easing program. This is a long-awaited, but predictable event. But the future prospects of monetary policy are very vague.

Some representatives of the Fed are lobbying for the idea of raising the interest rate, pointing to a jump in inflation. However, not all members of the committee share such zeal.

Representatives of the "dovish" wing of the Fed (including Jerome Powell) continue to insist that the inflation boom is a temporary phenomenon. And, therefore, it is not worth rushing to tighten the parameters of monetary policy. In which direction the pendulum will swing according to the results of the November meeting is an open question. In my opinion, the American regulator will disappoint dollar bulls, but the option of a "hawkish surprise" cannot be ruled out.

Therefore, today the risks of false price movements are especially high, and especially in the short period of time between the publication of the Fed's accompanying statement and Powell's speech at a press conference. During periods of such emotional volatility, it is best to stay out of the market: traders will not immediately crystallize their general opinion on the outcome of the November meeting, especially if the Federal Reserve voices contradictory and ambiguous signals.

Thus, today we can take a closer look at the main cross-pairs, among which the AUD/NZD pair should be singled out. The Australian dollar is actively losing ground against its New Zealand namesake. Corrective pullbacks are of a short-term nature, and the "downward wave" is gradually increasing. For example, over the past three trading days, the pair has been steadily diving downwards, reflecting increased demand for the New Zealand dollar. Today's released data only increased the pressure on the cross: data on the growth of the labor market in New Zealand came out in the "green zone," demonstrating the stress resistance of the economy of the island state.

The unemployment rate in New Zealand in the third quarter of this year fell to 3.4% - this is the best result in the last 13 years. Most experts expected to see this indicator at 3.9%. The number of employed increased immediately by 2% (on a quarterly basis), with a growth forecast of up to 0.4%. In annual terms, the component also came out in the "green zone," jumping to 4.2% (with a growth forecast to 2.7%). The share of the economically active population also increased to 71.2% (the previous value was 70.5%).

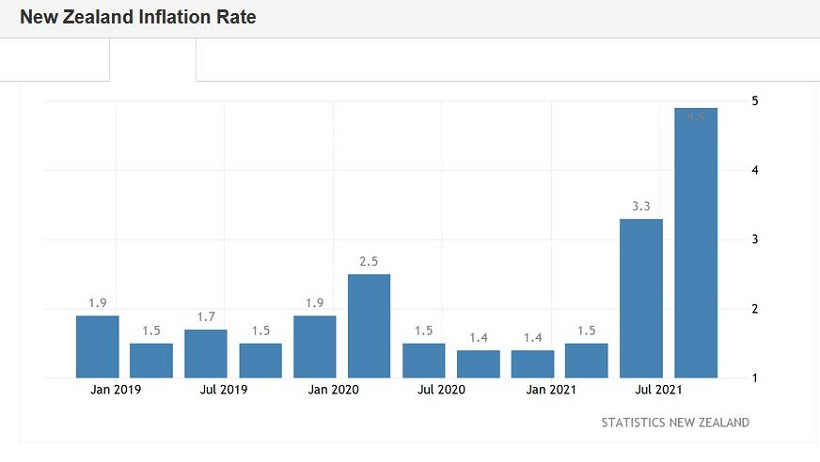

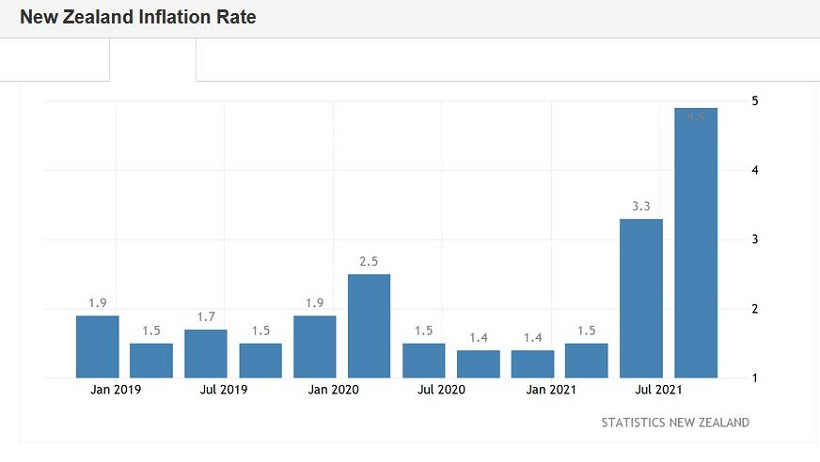

Here it is necessary to recall the dynamics of New Zealand inflation, which was published in mid-October. The consumer price index in the third quarter of this year jumped to 2.2% (QoQ). The indicator has updated a 10-year record: the last time the CPI was at a similar height (in quarterly terms) was in early 2011. On an annualized basis, the index also came out in the "green zone," at 4.9%. Both components of the release have been showing upward dynamics for several consecutive quarters, reflecting an increase in price pressure.

All this suggests that the Reserve Bank of New Zealand will maintain a "hawkish course." In early October, the RBNZ raised the interest rate by 25 basis points, that is, to 0.5%. Taking into account the rhetoric of the central bank representatives, as well as the dynamics of key macroeconomic reports, it can be assumed that at the last meeting of this year (November 24), the RBNZ will hold another round of rate hikes - up to 0.75%.

The head of the New Zealand central bank also did not rule out such a scenario, however, without specifying the time frame. According to him, the central bank may tighten monetary policy again, "if the necessary conditions for this remain in the country." It should also be noted here that in New Zealand, 75% of residents have already received two doses of the coronavirus vaccine. This suggests that quarantine restrictions will be relaxed again in the near future, and the probability of a new lockdown is reduced to almost zero.

The Australian dollar cannot boast of the RBA's hawkish attitude. On the contrary, following the results of the last meeting, the head of the central bank, Philip Lowe, voiced a very "dovish" rhetoric, despite the general optimistic mood of the regulator. He categorically ruled out the option of tightening monetary policy parameters within the next year. At the same time, Lowe noted that the hawkish expectations of the market "are extremely unrealistic" (it was a question of a possible rate hike next year). He also said that optimistic estimates regarding the recovery processes "do not indicate that the rate will definitely be raised before 2024." According to him, there is a "high degree of uncertainty" in this issue, so it is quite likely that the rate will remain at the current level until the designated border date.

Such a fundamental background suggests that the New Zealand dollar, together with the Aussie, will continue to be in high demand. The AUD/NZD pair has not exhausted its downside potential, so sales are still a priority.

Technically, the pair on the D1 timeframe is between the middle and upper lines of the Bollinger Bands indicator, in the Kumo cloud, but below the Tenkan-sen Kijun-sen lines. The main support level is at 1.0350 - at this price point, the lower line of the Bollinger Bands indicator coincides with the lower border of the Kumo cloud on the same timeframe. This target is the target of the downside movement in the medium term.