Bitcoin is more confidently implementing bullish impulses every week. For the first time in the bearish trend, the cryptocurrency began to receive significant dividends from the macroeconomic crisis. Rising inflation in the US and the EU combined provoked the need to inject cash into the markets to stabilize the situation with EUR/USD. The energy crisis is gradually fading due to political decisions, allowing investors to hope for a slowdown in interest rate hikes in the future.

Trading volumes on cryptocurrency exchanges are gradually returning to stable levels, and large investors are starting to join the accumulation trend. At the same time, the daily volumes of coins withdrawn from crypto exchanges reach 2%–3% of the total supply in circulation. Glassnode experts note a gradual decline in BTC coin sales. The market has almost completely cleared itself of speculative investors and large amounts of borrowed funds. It is evident in the current upward trend of Bitcoin, formed without sharp bursts of volatility and multi-million dollar liquidations.

In parallel, the BTC market is in the stage of a healing sale of coins. According to Glassnode, the main categories of investors who sell Bitcoin are long-term investors who bought a digital asset at high values and the remnants of speculative investors. The ultimate goal of this process is the gradual flow of BTC coins into the hands of long-term owners who are not subject to impulsive decisions. Also, all these factors point to the gradual formation of a local bottom, which is relatively painless for the market due to a decrease in short-term investors and a large number of transactions with large leverage.

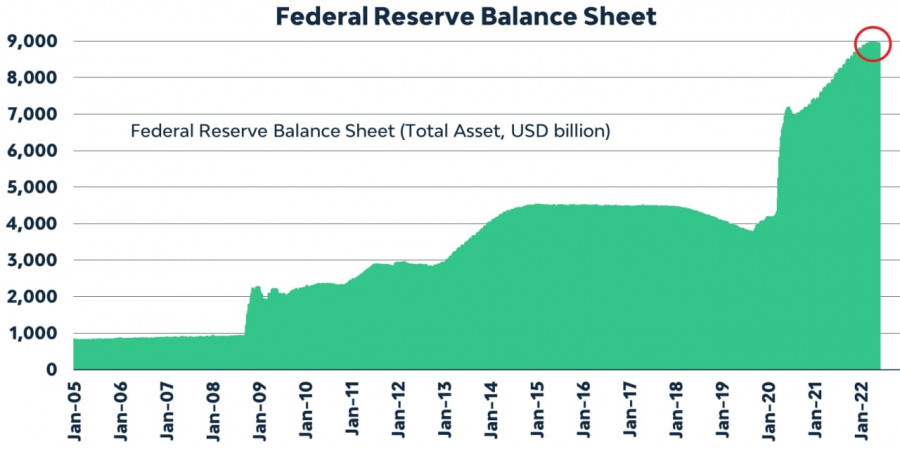

In addition, we see that Bitcoin has begun to justify its title as a store of value in times of crisis. The situation with EUR has shown that the Fed and the US dollar are not omnipotent, and, in the current conditions, it is impossible to abandon the printing press. In addition, it became known that the US is gradually forming a legislative framework for the transfer of frozen Russian funds to Ukraine. From a reputational point of view, large investors will have big doubts about the possibility of storing capital in the United States, which can also negatively hit the dollar. All these facts open the door for Bitcoin as a relatively independent and secure medium.

Despite the open window of opportunity, it is important to understand that it can close at any moment. Bitcoin really experienced the biggest drop and managed to stabilize, and the inflow of investments began to grow. However, the situation with EUR proves that the Fed's quantitative easing policy is working, and BTC and the stock market will be the first to lose liquidity when it resumes.

In addition, there are many rumors on the market about a possible increase in the key rate by 100%, despite the passage of the peak of inflation. It is associated with the negative indicators of the reporting week, showing that the price is growing for absolutely everything. Energy costs rose by 41.6%, the highest since 1980. Gasoline rose in price by 59.9%, and fuel oil by 98.5%. Food prices rose by 10.4%, while real estate prices rose by 5.6%. The Core Consumer Price Index, which excludes food and energy, rose 5.9%, above the 5% forecast.

All these factors negatively affect Bitcoin in the medium term since, most likely, it is in July that the Fed will tighten monetary policy as much as possible. The stock and crypto market will be the first victims of further outflow of liquidity. At the same time, Bitcoin still has the problem of miners. The hashrate of the cryptocurrency has fallen by almost 40% from the maximum, indicating the shutdown of some of the miners' equipment. In addition to reducing the cost of BTC mining, an important role was played here by the rise in energy prices, which puts miners' balances at risk of sell-off.

Given the fundamental factors, we should not expect a protracted upward movement of Bitcoin. Most likely, we will have an unsuccessful retest or a false breakout of the $22.3k level, after which the coin will return to consolidation within the $19k–$22.3k range. Despite the influx of liquidity, it will not be possible to realize a strong upward movement, and in the current conditions this will help maintain the current level of volatility and continue the consolidation period for further growth under more favorable conditions.