The GBP/USD currency pair posted a 300-pip upward move from Wednesday evening through Thursday. Given the current situation, this may not end the dollar's decline. To be honest, the fall of the dollar is actually working in America's favor, as Trump has introduced tariffs of 10% for most countries, while the dollar itself has depreciated by roughly the same 10% during Trump's time in office. The cheaper the dollar is globally, the more attractive U.S. goods and commodities become. However, this argument now seems highly questionable.

We believe the dollar's decline is not due to fears of a U.S. recession or other negative economic outcomes. The dollar's drop in both early March and early April appears to be more of a protest against America and Donald Trump personally. It's important to understand that behind every country are ordinary people. Of course, global consumers won't suddenly stop buying American goods altogether, but even a 30% drop in aggregate demand would harm the U.S. economy.

That said, things are now likely to go badly for everyone. Experts warn that many goods—tariffed or not—will become more expensive. First, many countries are ready to retaliate against Trump with their tariffs. Second, Trump has made it clear that he will respond to any countermeasures with new tariffs of his own. So far, we've seen only the beginning of the trade war, and further escalation is highly likely. Third, if the products of one automaker suddenly rise in price, others may raise their prices as well. In short, the world faces a sharp price spike and a narrowing of available product choices.

As unfortunate as it is, the ones who will pay for this trade war are ordinary consumers. They'll either pay more for the same products or search for cheaper alternatives. Macroeconomic data on Wednesday and Thursday had absolutely no impact on the market. The U.S. will release Nonfarm payroll data and unemployment figures on Friday, and Federal Reserve Chair Jerome Powell is scheduled to speak. But does anyone believe these reports and events will support or help the dollar recover? Trump's actions have essentially shattered the downtrend on the daily timeframe. If the U.S. president continues this path, even the long-term 16-year trend could be broken. Unfortunately, this is one of those times when technical analysis on higher timeframes does not influence price movement. The market is in a state of panic, and traders are aggressively dumping the dollar. This could turn into a prolonged process.

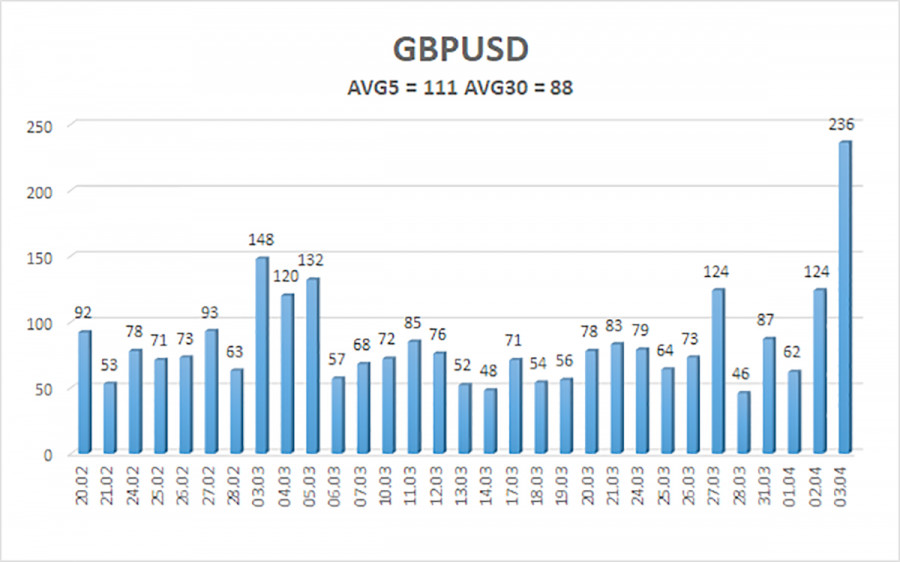

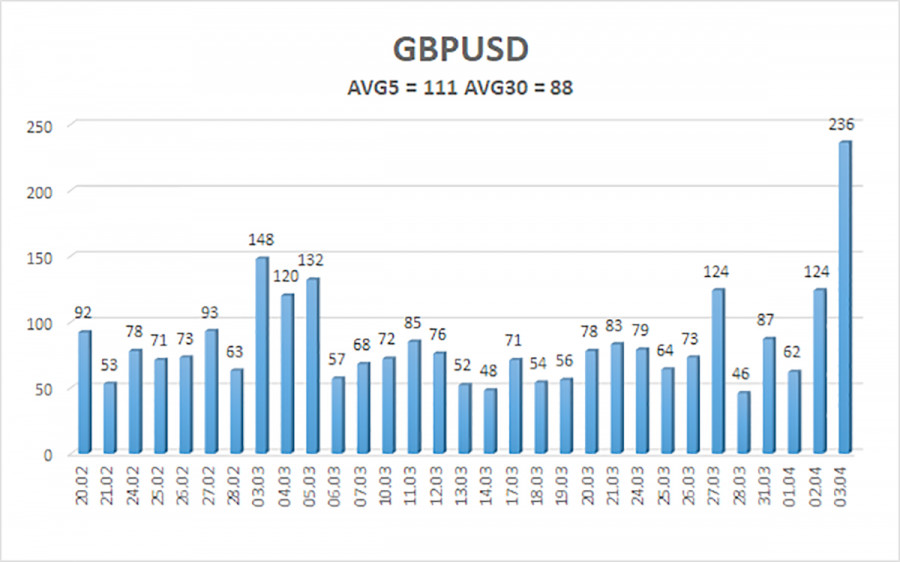

As of April 4, the average volatility of the GBP/USD pair over the past five trading days stands at 111 pips, which is considered high for this pair. On Friday, we expect movement within the range of 1.3000 to 1.3222. The long-term regression channel is pointing upward, indicating short-term strength, but the downtrend on the daily chart remains intact. The CCI indicator recently entered overbought territory, which signaled a downward pullback.

Nearest Support Levels:

S1 – 1.3062

S2 – 1.2939

S3 – 1.2817

Nearest Resistance Levels:

R1 – 1.3184

R2 – 1.3306

R3 – 1.3428

Trading Recommendations:

The GBP/USD pair continues its strong upward movement, driven by just one factor—Donald Trump's trade policy. We still do not consider long positions viable, as we view the current rise as a correction on the daily timeframe that has taken on an illogical form. However, if you trade solely on technicals, long positions remain valid with targets of 1.3222 and 1.3306. The pound may continue rising if Trump continues to introduce new tariffs. Short positions remain attractive with targets at 1.2207 and 1.2146 since, sooner or later, the upward correction on the daily chart will end—assuming the previous downtrend hasn't already ended by that time. Even if we're now witnessing the beginning of a new uptrend, a downward correction is necessary, as the pound has been rising almost without any pullbacks.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.