The GBP/USD currency pair continued its near-crash-like decline throughout Monday. Can anyone even explain, in hindsight, what's happening in the markets right now? There are no questions regarding the drop in U.S. stocks, indices, cryptocurrencies, or oil. Nor are there any questions about the fall of the U.S. dollar last week. We have consistently stated that the situation in the U.S. under Trump's leadership is not dire enough to warrant a continual decline of the dollar. And now, the British pound is plunging for the second day while the dollar is rising. This raises a new question: Why is the pound falling?

We've spent several weeks saying the dollar had fallen too far, especially given that Trump's tariffs don't just affect the U.S. The trade war will have negative consequences for all participating countries. Yet, for some reason, only the dollar was falling. And now that the dollar is rising and the pound is falling, we face the opposite question.

This sort of illogical movement is happening because neither the dollar nor the pound is actually "rising" or "falling" in the traditional sense. Currencies are swinging wildly from side to side. And when prices fly around like this, it's tough to consider such movements consistent or orderly. For instance, last week, we saw the U.S. dollar collapse by nearly 300 pips in a single day. But on Friday and Monday, the pound dropped more than 400 pips. What changed on Friday or Monday to justify such a sharp move in the British currency? There's no clear answer. Clearly, in a state of panic, the market stopped buying the pound and started selling it while reversing its position on the dollar.

We've said it many times in our analysis—these wild swings in the forex market are like playing roulette or betting on a horse race. Sure, you might get lucky and score a significant profit. But you also might not. Our reviews aim to find logic and patterns in market movements. And if there's no logic, we say so. The dollar is rising, which aligns perfectly with the long-term trends in the daily and monthly timeframes, suggesting a return to the 1.2000 level or even lower. However, the same factors dragging the dollar down for the past three months are still in play. So why is the dollar now strengthening? And more importantly—how far can it rise?

It's important to remember that an expensive dollar, under the current circumstances, is almost a death sentence for the U.S. economy. Export volumes will fall significantly due to the trade war, and if the dollar continues to appreciate, American goods and raw materials will become even more inaccessible on global markets. The U.S. has imposed tariffs on China, but other countries haven't imposed sanctions on Beijing. The U.S. risks being "pushed out" of the global trade system, easily replaced by others, while Trump's strategy could only worsen the trade balance deficit.

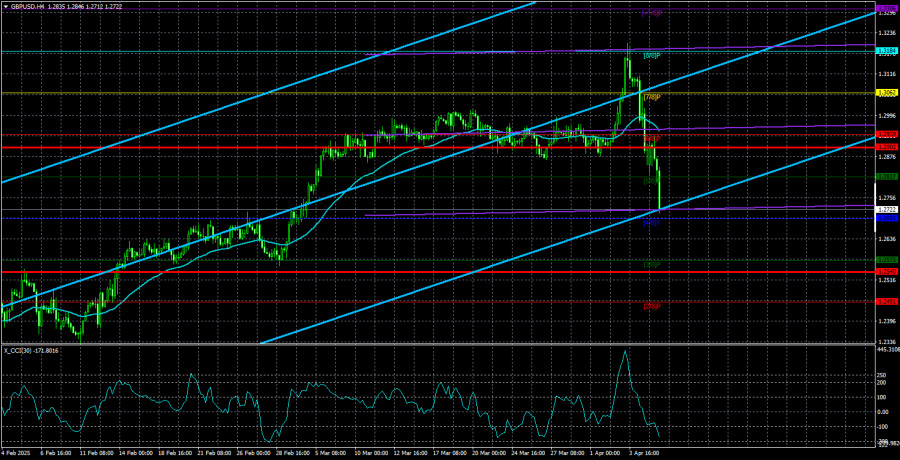

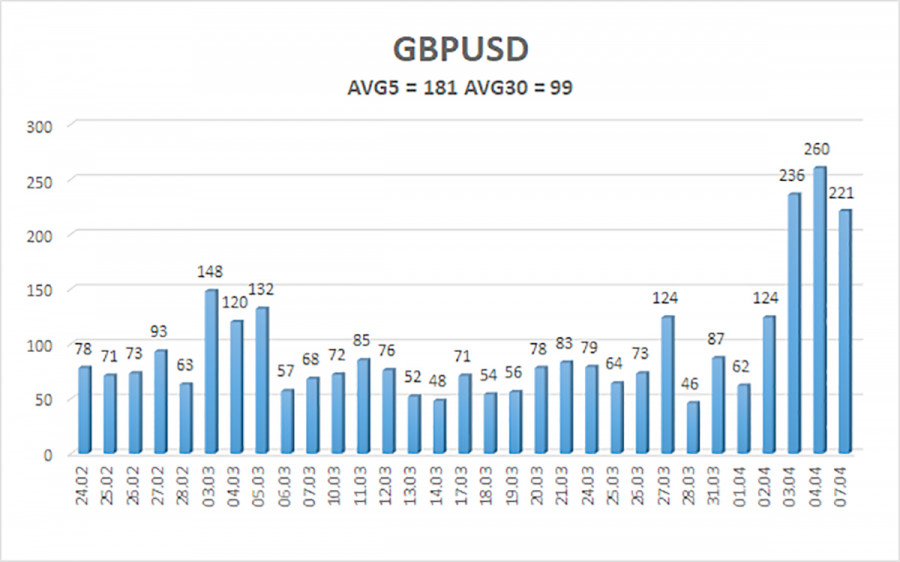

The average volatility of the GBP/USD pair over the last 5 trading days is 181 pips, which is considered "high." On Tuesday, April 8, we expect the pair to move within a range bounded by the levels of 1.2540 and 1.2902. The long-term regression channel is pointing upward, but the downward trend persists on the daily timeframe. The CCI indicator entered overbought territory, signaling a downward correction—which has already begun with force.

Nearest Support Levels:

S1 – 1.2695

S2 – 1.2573

S3 – 1.2451

Nearest Resistance Levels:

R1 – 1.2817

R2 – 1.2939

R3 – 1.3062

Trading Recommendations:

The GBP/USD pair has sharply started a collapse, which could become a long-term correction—or even a new trend that we've been expecting for months. We still do not consider long positions viable, as we view the entire upward move as a corrective wave in the daily timeframe, which has become irrational. However, if you're trading based on pure technicals, long positions are still valid with a target of 1.3184 if the price remains above the moving average again. The pound could continue to rise if Trump continues to introduce tariffs and other countries implement retaliatory measures.

Short positions remain attractive, with targets at 1.2207 and 1.2146, because the upward correction on the daily timeframe will end sooner or later—unless the previous downtrend is entirely broken. Even if we are currently witnessing the start of a new uptrend, a downward correction is still needed, as the pound has risen too fast.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.